Financial Planning

To us, comprehensive financial planning and wealth management means creating a strategic approach for combining various life goals alongside financial goals. At Liberty Wealth Strategies, we specialize in creating a long-term financial plan while maintaining short-term objectives. Once a plan is established, we deliver a high level of service to monitor our client’s progress by focusing on the specific objectives stated.

To our firm, it’s about more than just investing. It’s about fulfilling the dynamic needs of the families and businesses we serve. Our clients rely on us for more than just financial planning, investment management & insurance services. Listening to our clients closely, we use a holistic approach that allows us the opportunity to make referrals in other areas such as banking, estate planning and taxes.

We invite you to watch a brief video that explains the financial planning experience provided by using our software with MoneyGuidePro.

Risk Assessment

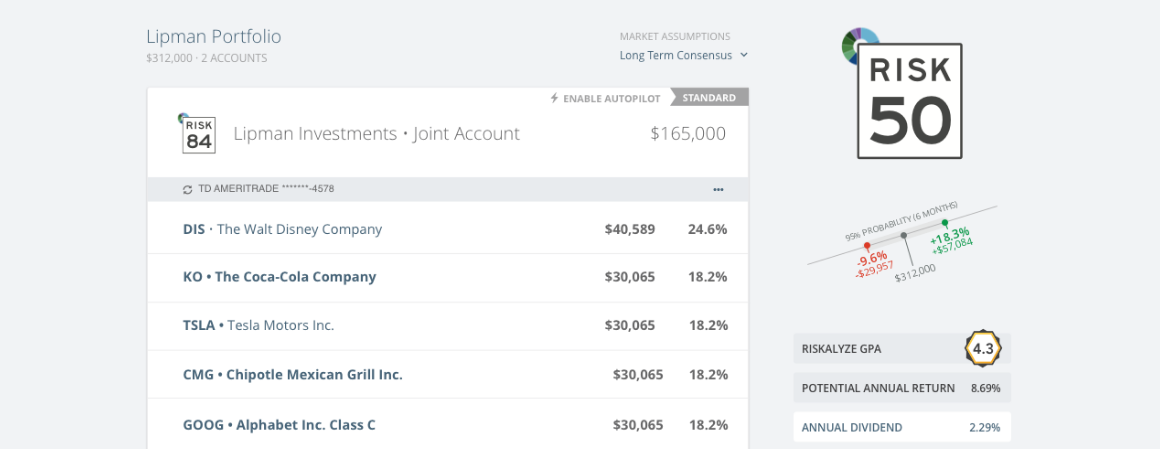

RISK NUMBER® TECHNOLOGY

Riskalyze is a cutting-edge technology platform that pinpoints your acceptable levels of risk and reward with unparalleled accuracy. Knowing your Risk Number® helps us ensure that your portfolio aligns with YOUR investment goals and expectations. Together we can take the guesswork out of your financial future.

DISCOVER YOUR RISK NUMBER

Your first step is to take a 5-minute quiz that covers topics such as top financial goals and what you’re willing to risk for potential gains. Then we’ll identify your exact Risk Number to determine any modifications needed in your current portfolio.

REVIEW YOUR CURRENT INVESTMENTS

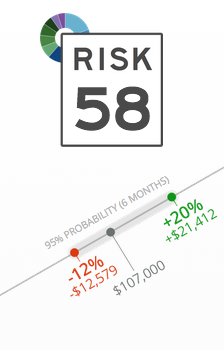

It turns out 4 out of 5 people have more risk in their portfolios than they even realize! Riskalyze technology empowers us to make sure the Risk Number of your portfolio matches your personal Risk Number.

ALIGN YOUR PORTFOLIO TO MATCH YOU

After identifying your Risk Number, we’ll craft a portfolio that aligns with your personal preferences and priorities, allowing you to feel comfortable with your expected outcomes. The proposed portfolio will include projections for the potential gains and losses we should expect over time.

STRESS TEST YOUR INVESTMENTS

Stress tests illustrate how your proposed portfolio would have fared through various market events in past years, including the financial crisis, recovery and interest rate hikes.

REVIEW RISK & REWARD POTENTIAL

We can visualize the risk and reward profile for each individual investment we propose for your portfolio. Illustrating risk, reward and diversified risk gives us a powerful tool to review before we make any final investment decisions. This section also allows us to act as a true fiduciary throughout our relationship.

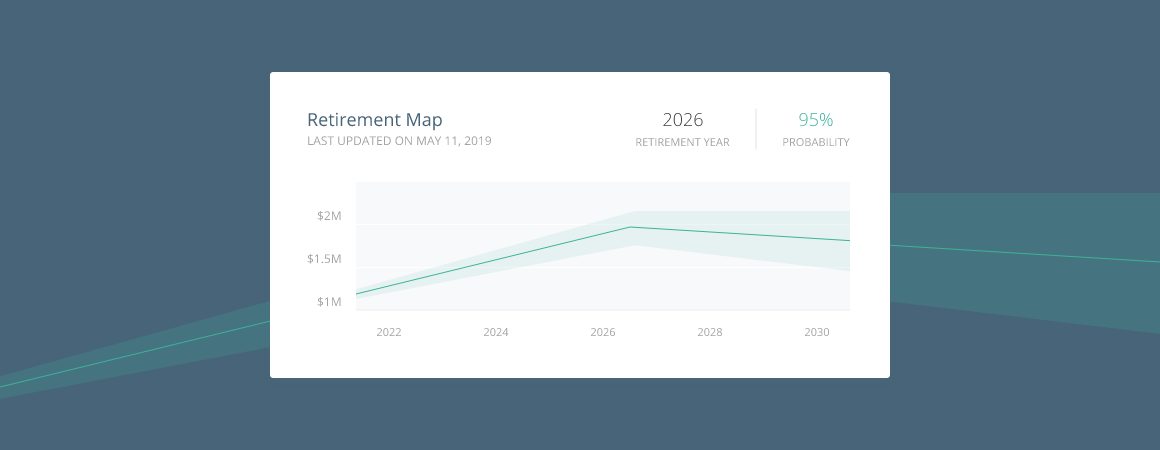

MEET YOUR RETIREMENT GOALS

Before you know it, we’ll review your progress toward your financial goals by building a Retirement Map. When you’re done, you’ll fully understand the probabilities of success, and what we can to do to increase it.

Wealth Management

Liberty Wealth Strategies works closely with community banks and outside institutions such as AssetMark Trust to ensure each family we serve receives a wealth management experience, regardless of your account size.

Custom Investments

Complement your portfolio with investments tailored to your unique situation.

- Custom investment solutions

- Tax-smart investments & guidance

- Covered-call option strategies

Banking & Cash Management

Maximize your everyday cash with banking and lending products that align with your goals.

- Checking accounts

- Concierge mortgage services

- Securities-backed lines of credit

- Expanded FDIC insurance on cash assets

Wealth Transfer

Establish your legacy and be confident that your wealth will be used how you want.

- Estate planning

- Trust administration

- Charitable giving

Investment Management

Liberty Wealth Strategies is committed to utilizing multiple custodial platforms in order to provide the right products & services for our customers in a cost-effective manner. We do this through our broker dealer's relationship with Fidelity Investments, National Financial Services, AssetMark Trust & Betterment.

Premier Managed Account

Bundled Managed Account Solution

Designed for clients who prefer an efficient account structure. Accounts are managed by time horizon, investment objectives and risk tolerance using an asset allocation model. Investment decisions using Individual Stocks, Individual Bonds, ETFs, Separately Managed Accounts and Mutual Funds are made by professional Investment Advisors based on stated investment goals and are rebalanced regularly. Investment advisory fees are “bundled” together with tiered asset-based pricing.

Signature Managed Account

Unbundled Managed Account Solution

Designed for clients who prefer a hand with investment decisions and rely on an Investment Advisor for guidance. The platform is designed to provide complete open architecture and allows for numerous trade types; ETF’s, Mutual Funds, Individual Equities, Fixed Income solutions, Options and certain complex investments. Collaborative decisions are made between the client and Investment Advisor, including fee structure. Investment advisory fees are “unbundled”, allowing a truly customized experience where the client and Advisor determine the level of services needed for the account, which can result in a lower cost to administer the portfolio.

Third Party Money Managers

Access to the industry’s top investment managers

Our partnership with Third Party Money Managers provides access to the industry’s top investment managers. By using third-party investment managers, Advisors eliminate the responsibility of day to day portfolio management, risk management, trading, rebalancing, performance reporting, cash reconciliation and various administration and operational services. Relinquishing these daily responsibilities creates more time for the client and the Investment Advisor to focus on goal based financial planning in a more cost-effective manner.

Digital Investment Advice

Access to the industry’s top Digital Investment Advice Solutions

Digital Advice Solutions provide a variety of advisory services to clients via internet-based investment platforms. By using advanced technology for all or some of your investment management needs Advisors eliminate the responsibility of day to day portfolio management, risk management, trading, rebalancing, performance reporting, cash reconciliation and various administration and operational services. Relinquishing these daily responsibilities creates more time for the client and the Investment Advisor to focus on goal based financial planning in a more cost-effective manner.

Brokerage Account

A brokerage account allows the investor to make investment decisions on a transactional basis. Clients have the flexibility to buy or sell Stocks, Bonds, CD's, ETF’s, Mutual Funds and Alternative Investments within a singular account. Although the account is not actively managed by an Investment Advisor, a Registered Representative assigned to the account can make solicited trades or the investor can contact the Registered Representative to make unsolicited trades.

General Securities Account

Want to consolidate and maintain existing investments without having to sell them? A general securities account can hold your existing assets without having to receive statements from multiple investment providers, allowing you to make investing simpler.